Alliance Medical Fund I

Fund terms summary

Summary of Fund Terms

Manager Name:

Alliance Medical Fund I Manager LLC

Fund Name:

Alliance Medical Fund I LLC

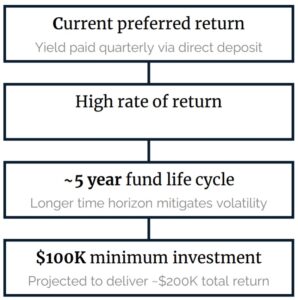

Fund Size:

$50,000,000

Minimum Commitment:

$100,000

Members Classes:

Class A - >$2.5M; Class B - $1M to $2.5M; Class C - <$1M

Target Return:

14% to 18%

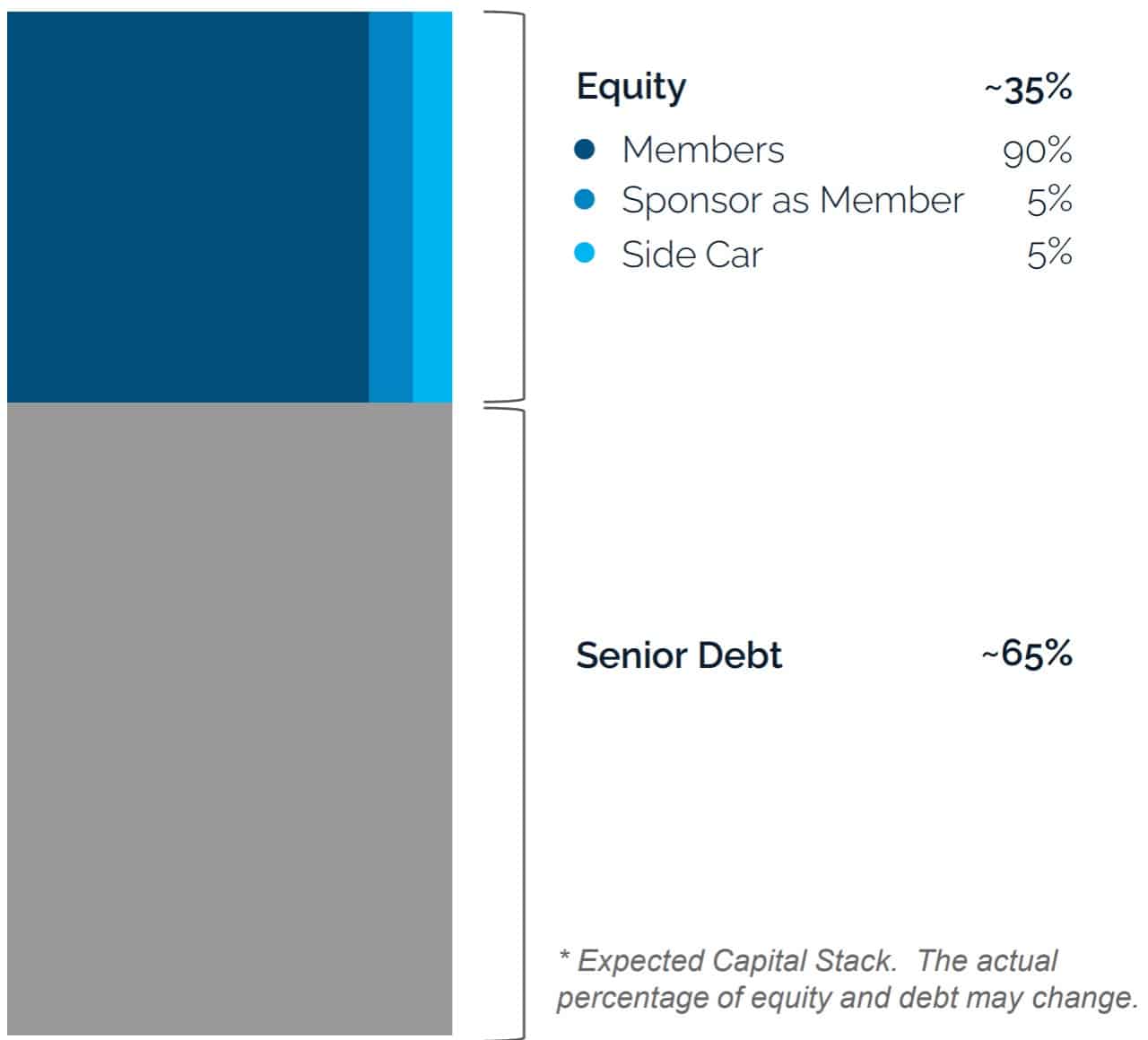

Fund Management Fee:

1.0% annually on contributed capital

Preferred Return:

8% for Class A Members (2% will be accrued) ; 7% for Class B (1% will be accrued) ; 6% for Class C

Catch-up:

None

Carried Interest:

40% up to a 12% IRR and 50% thereafter

Raise Period:

Up to 24 months

Investment Period:

Up to 36 months

Fund Term:

Target 5 years

About Alliance Investments

Leadership Team

Our people is what makes Alliance a top performer. We have 200+ years combined experience in Commercial Real Estate.

We love what we do, and have a seasoned team who have worked together for many years.

We know what it takes to deliver value to our investors and approach each day as an opportunity to find opportunities, solve problems, and create value.

Subscribe to our commercial real estate newsletter.

About Alliance Investments

About Alliance

27 years ago Alliance was founded

17 years focused on medical office; pioneer

200+ years combined real estate experience

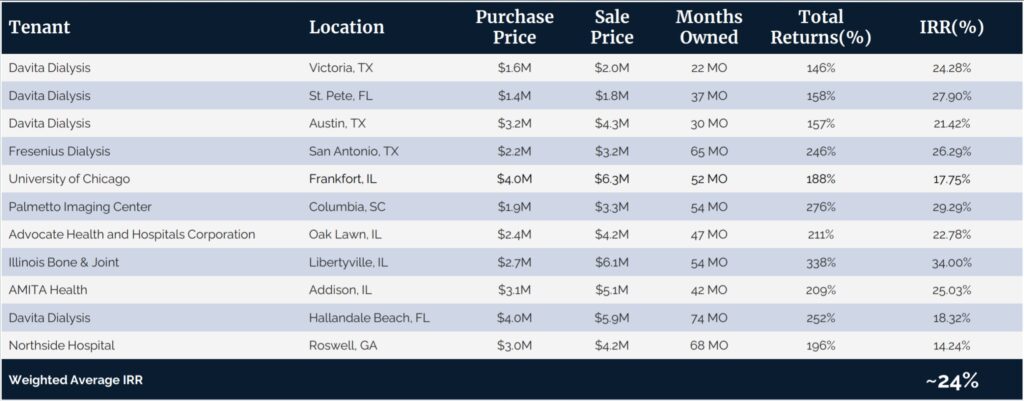

High IRR historical performance *

2x multiple on investments over past 10 years

Leadership team recognized as prominent experts in Commercial Real Estate with multiple awards and recognitions

* Past performance is no guarantee of future results.

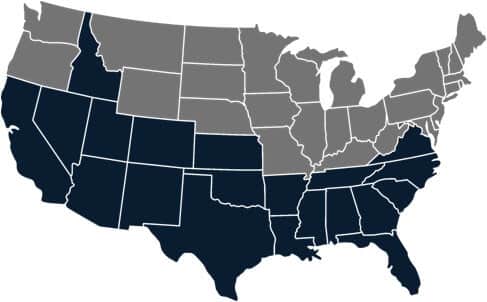

Where we invest

We invest in growth areas

![]() Areas Alliance Invests

Areas Alliance Invests

Key acquisition criteria

- Medical and veterinary properties

- Net lease

- Rental growth in initial lease term

- Tenant has large investment in the property

- Dense population areas

- Strong population growth

- Pro-growth states, municipalities

- Favorable tax municipalities

Fund Overview

Overview of Alliance Medical Fund I

Capital Stack *

Why medical office real estate?

Benefits of investing in Medical Office Real Estate

Healthcare industry is strong and resilient to downturns

- Alliance has received 100% of rent payments since pandemic began

- Amongst fastest growing industries, in terms of both demand for services and workers

Tenants stay long term, and have high switching costs

- Tenants invest significant capital in the property, e.g. equipment

- Limited options to move locations, e.g. zoning, hospital proximity, patient disruption

Sector is not reliant on new development

- Majority of the transactions involves sale-leasebacks with physician-owned practices

- Strong returns avoid the inherent risks of investing in ground-up projects

Cap rate and yield arbitrage

- Common for the cap rate differential on medical office to be 200+ basis points higher, while also being relatively low-risk versus alternative real estate asset classes

Why invest in a real estate fund?

Real estate funds offers investors unique value

Why invest in real estate?

Why invest in a fund?

How we create value for our investors

We have time-tested strategies to drive value for investors

We know what to buy…

Tenant arbitrage

- Positioned to grow

- Improve balance sheet

- Improve credit

- Investment in property

… where to buy…

Supply-and-demand

- Population, target demographic growth

- Supply constraints

- Barriers to entry

Right municipalities

- Pro-growth policies

- Favorable taxes

… how to sell…

Renewal contract arbitrage

- Widest audience appeal

- Terms that maximize value

- Story that resonates

… and when to sell

Sell at the peak

- Ability to hold

- Experience with different cycles

Winning story for buyers

- Turnkey buying experience

- Check-in-mail properties

Increasing cash flow along the journey

Annual escalations preserve cash flow value, growing income stream with tenant growth

All investments involve risk. Past performance is no guarantee of future results.

Secret sauce to find winning properties

Alliance is uniquely positioned to find, close deals

Relationships

Nurtured hundreds of relationships over 25+ years

- Procure deals off market

Marketing & PR

Highly active social media

- Including directly engaging physician property owners

Marketing database highly nurtured over decades

PR highlighting wins and promoting Alliance brand

Brand & Reputation

Preferred buyer for brokers

- Brokers know we are trustworthy and confident in our ability to close

Subscribe to our commercial real estate newsletter.

DISCLAIMER

This Investment Presentation (the “Investment Presentation”) is provided for informational purposes only to prospective investors who are considering making an investment in Alliance Medical Fund I LLC (the “Fund”). The offering of membership interests in the Fund is being made to facilitate investors’ purchase of interests in real property. The terms of the offering described in this Investment Presentation have not been finalized and are subject to change. The Investment Presentation is not intended to be, and must not alone be taken as, the sole basis for an investment decision. In making an investment decision, prospective investors must rely on their own examination of the Fund and the terms of the offering of membership interests in the Fund, including the merits and risks involved. Any investment in the Fund is highly speculative and involves significant risks, including but not limited to those risks described in the “Risk Factors” section of the PPM. Past performance is no guarantee or indication of future success.